Medicare Insurance

Medicare Insurance is a health insurance program to help those 65 or order afford good, quality healthcare. Medicare is broken up into four parts: A, B, C, and D. Both A and B are government sponsored plans that cover some basic health insurance needs like hospitals stays and doctor visits. If you need more coverage for things like prescription drug benefits, dental or hearing you’ll need what’s call a Medicare Supplement. There are several ways to put together a Medicare Supplement package to make sure you get the best coverage at an affordable price.

Medicare Supplement Plans

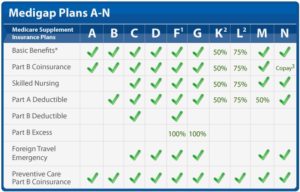

There are 11 different Medicare Supplement plans, also known as Medi-Gap, available to individuals on Medicare. Each plan is designated by a letter of the alphabet, ranging from Plan A – Plan N. All Medicare Supplement plans are the same plan among every company who offers it. The only difference is the price they charge for the premium, that is why it is important to compare prices before you signup. Get a quote to check the best prices in California and you could save yourself an extra 40-50%.

Medicare Prescriptions – Part D

Medicare Prescription Part D is insurance coverage for your prescription drugs. This coverage is offered to everyone on Medicare. If you don’t enroll in a prescription drug plan when you first become eligible for Medicare, you’ll likely pay a late enrollment fee unless you have other prescription coverage already or are receiving Extra Help.

Medicare Insurance

Medicare Insurance is a health insurance program to help those 65 or order afford good, quality healthcare. Medicare is broken up into four parts: A, B, C, and D. Both A and B are government sponsored plans that cover some basic health insurance needs like hospitals stays and doctor visits. If you need more coverage for things like prescription drug benefits, dental or hearing you’ll need what’s call a Medicare Supplement. There are several ways to put together a Medicare Supplement package to make sure you get the best coverage at an affordable price.

Medicare Part A deals with your hospital insurance. Like most people, you qualify for premium-free Part A if: you turn 65 and you or your spouse paid Medicare taxes while working, or prior to turning age 65: you become permanently disabled or have EndStage Renal Disease. Upon Satisfying one of these requirements, you will automatically be enrolled in Part A unless otherwise requested.

Part A Covers

- General Hospital Care (the stay and nursing services rendered, excluding major procedures done within the hospital, such as surgery)

- Skilled Nursing Facility Care (after spending at least 3 days in the hospital)

- Nursing Home Care (as long as custodial care isn’t the only care you need)

- Hospice Care

- Home Health Services

You are responsible for the Part A deductible, which is the fist $1,315 of each benefit cycle (generally every 6 months). In addition, if you have spent a certain number of days in any of the aforementioned facilities, you are also subject to a daily co-pay (as much as $644).

This is when a Medicare Supplement (MediGap) plan comes into play; you can obtain a plan that pays 100% of this deductible and all co-pays (both Medicare Supplements Plan F and Plan N).

Part B

The second part of Medicare is Part B, which is your medical insurance. Some people automatically get Part B coverage, whereas others have to sign up when they first become eligible. Most people pay the standard premium is normally automatically deducted from your social security check. If you’re not going to be receiving a social security check, you will need to make an appointment with your local social security office to arrange a payment plan.

Part B Covers:

- Medically necessary services, both inpatient and outpatient, including physical and speech therapy

- Preventative services, such as flu prevention

- Clinical research

- Ambulance services

- Durable Medical Equipment

- Mental Health Care: inpatient, outpatient and partial hospitalization.

Each year the first $183 worth of services is your responsibility; this is the Part B deductible. After the deductible had been met, Medicare will generally cover 80% of the remaining charges. The last 20% is also your responsibility, without a “cap” an no “stop loss”. Obviously, this means you are taking on a huge risk. However, a Medicare Supplement/Medi-Gap plan, such as Plan F, would pay for both the deductible and the 20% excess charges.

Medicare Supplement Plans

There are 11 different Medicare Supplement plans, also known as Medi-Gap, available to individuals on Medicare. Each plan is designated by a letter of the alphabet, ranging from Plan A – Plan N. All Medicare Supplement plans are the same plan among every company who offers it. The only difference is the price they charge for the premium, that is why it is important to compare prices before you signup. Get a quote to check the best prices in California and you could save yourself an extra 40-50%.

Plan F (most popular)

There are 11 different Medicare Supplement plans available to individuals on Medicare. Each plan is designated by a letter of the alphabet, ranging from Plan A – Plan N.

The most popular Medicare Supplement plan on he market today is: Plan F.

Plan F pays the deductible for both Medicare Part A and Part B. In addition, it also pays for all hospital and skilled nursing co-pays (including reserve days), your Part B co-insurance and any Part B excess charges. With Plan F, you have no deductibles, no co-pays and no co-insurance, making it the best plan available. For those on Medicare, this plan is a close to 100% coverage as you can get.

Like every Medicare Supplement plan, the Plan F is the exact same plan among every company who offers it. For example: AARP’s Plan F is the same as Blue Shield’s Plan F, which is the same as Aetna and Health Net’s Plan F, and so on; each company offers the same benefits for each plan. The only difference from one company to the next is the premium you pay for that coverage. This is one of the primary reasons individuals utilize agents/brokers; to shop all these rates to locate the lowest premium for you! If the Medicare Supplement Plan F does not fit within your budget, the next best plan available is the Plan N; this is considered as a “middle of the road” plan.

Plan N (value plan)

The Plan N is likened to the Plan F, but while Plan N offers a more affordable premium, it also has more out-of-pocket expenses.

Under the Plan N, the insured has up to a $20 co-pay for each doctor/office visit and, unless admitted, a $50 co-pay for each emergency room visit (the fee is waived if the insured is admitted).

The insured would also be responsible for the Medicare Part B deductible of $183 each calendar year. The last major difference is referred to as Medicare Part B excess charges. This refers to an instance where a doctor seeks more compensation for a procedure than Medicare feels is necessary and is willing to pay (Medicare assignment). With a Plan N, the insured could be held responsible for up to 15% of these charges. However, s/he could avoid the charges by seeing a doctor whom accepts “assignment” (the Medicare-approved amount).

Like the Plan F and all Medicare Supplement plans, the Plan N has the exact same benefits among every insurance company who offers it; the only difference is the premium each company charges for this plan.

Request a quote to find out which plan is right for your budget.

Medicare Prescriptions – Part D

Medicare Prescription Part D is insurance coverage for your prescription drugs. This coverage is offered to everyone on Medicare. If you don’t enroll in a prescription drug plan when you first become eligible for Medicare, you’ll likely pay a late enrollment fee unless you have other prescription coverage already or are receiving Extra Help.

To enroll in a Prescription Drug Plan, you must enroll in a plan offered by a Medicare approved insurance company. Unlike health insurance, you cannot enroll in these plans any day of the year, there are specific periods when you’re able to enroll:![]()

The first period is called the Initial Enrollment Period. You’re able to purchase a Part D plan during the period you first go on Medicare. You have 3 months prior to your Medicare effective date and 3 months after.

If you miss this opportunity to enroll, you cannot obtain coverage until the Annual Enrollment Period, which takes place Oct. 15 – Dec. 7 each year. You cannot make changes to your drug plan outside this period, unless you qualify for a special enrollment.

There are numerous insurance companies that offer Part D drug prescription plans. Make sure you take advantage of your initial enrollment period so you are not penalized with a late fee.

MedicareSupplements.US

MedicareSupplements.US is owned and operated by Withrow Insurance Services to proved information and resources to people who are on medicare or nearing the age when they will be eligible.

In four easy steps, Withrow Insurance can evaluate your current or potential medicare insurance and determine whether you will need supplemental medicare insurance and provide you with the best prices on the market.

Withrow Insurance Services provides continued services to make sure you are always getting the best prices even after the first consultation.

Next Steps...

Get a FREE medicare consultation to see if you could save on your medicare supplement insurance.

*Consultations provided by Withrow Insurance Services for Northern California residents only